Which Best Describes an Owner's Equity in the Property

Owners Equity Assets - Liabilities. Which of the following statements best describes owner-occupied property.

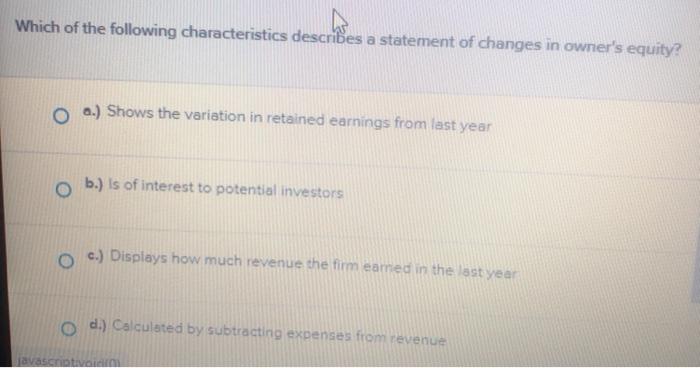

Solved Which Of The Following Characteristics Describes A Chegg Com

In simple terms owners equity is defined as the amount of money invested by the owner in the business minus any money taken out by the owner of the business.

. In simple terms owners equity is defined as the amount of money invested by the owner in the business minus any money taken out by the owner of the business. If a real estate project is valued at 500000 and the loan amount due is 400000 the amount of owners equity in this case is 100000. Log in for more information.

In the balance sheet owners equity is the term. Which BEST describes an owners equity in the property. Owners equity is one of the three main sections of a sole proprietorships balance sheet and one of the components of the accounting equation.

The owners interest or worth in the business. Assets will include the inventory equipment property equipment and capital goods owned by the business as well as retained earnings which may be in the form of cashin a. Example of Home Equity.

Equity is the difference between the amount owed on the property and the value of the property. Started the business one year back and at the end of the financial year ending 2018 owned land worth 30000 building worth 15000 equipment worth 10000 inventory worth 5000 debtors Debtors A debtor is a borrower who is liable to pay a certain sum to a credit supplier such as a. Reviewed by Dheeraj Vaidya CFA FRM.

This shows you how much capital your business has available for activities like investing. A The value of the property b The value over and above the outstanding mortgage balance c The amount of equitable redemption d The amount of the commission owed on the sale. Which of the following best describes accounts receivable.

Owners equity is an owners ownership in the business that is the value of the business assets owned by the business owner. Fun time International Ltd. Statement of Owners Equity c.

The value over and above the outstanding mortgage balance. What the business owes. Owners equity also referred to as net worth equity or net assets is the amount of ownership you have in your business after subtracting your liabilities from your assets.

Your home equity is your personal financial investment in your home. Lets assume John has a company John Travels LimitedThe entity has 150000 of owners equity at the beginning of a reporting period Reporting Period A reporting period is a month quarter or year during which an organizations financial statements are prepared for external use uniformly across a period of time in order for the general public and users to. A promissory note would.

The lender obtained a court order to foreclosure on the property. At the foreclosure sale Ronalds house sold for 29000 and the unpaid balance on his loan is 40000. Equal to the business liabilities less the business assets B.

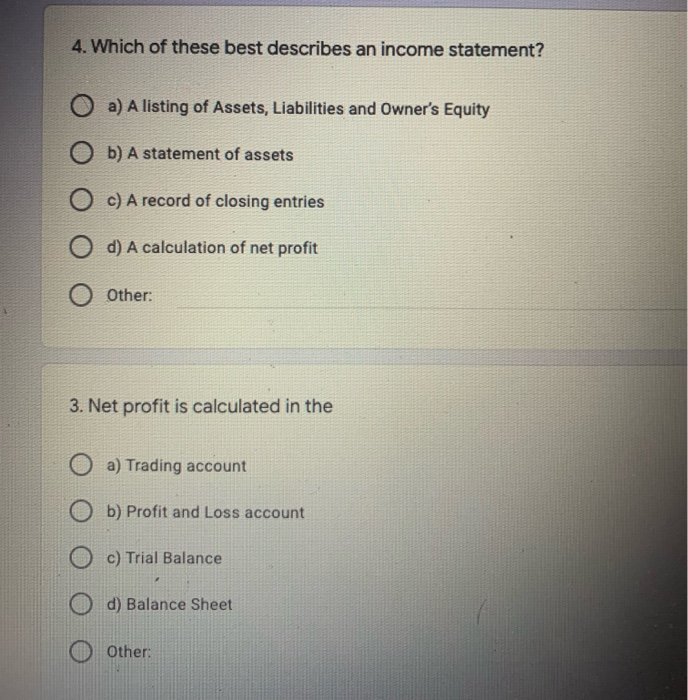

Its Rodneys first year in business and he had the following transactions. Assets Liabilities Owners Equity. In real estate your equity in your property is the amount that you own or what you would get after paying off your mortgage after selling.

The value over and above the outstanding mortgage balance. In other words if the business assets were liquidated to pay off creditors the excess money left over would be considered owners equity. Statement of changes in equity.

In other words its the difference between the amount of assets and the value of. Owners equity is generally considered one of the three main aspects of a companys finances as it is part of the accounting equation. That is why it is often referred to as net assets.

The owners interest or worth in the business. Examples to Calculate Owners Equity Example 1. Its important to note that your homes equity is.

Which of the following statements best describes owner-occupied property. You can lose equity by increasing your loan amount reducing the value of the house. Assets Liabilities Owners Equity.

The owners interest or worth in the busines. Property held to earn rentals d. For example lets look at a fictional company Rodneys Restaurant Supply.

Property held for use in production and supply of goods or services and property held for administrative purposes c. You can build equity by making a larger down payment paying off your mortgage more quickly and improving the house to increase its value. Owners equity is equal to the business assets less the business liabilities.

Only sole proprietor businesses use the term owners equity because there is only one owner. Owners equity often called net assets is the owners claim to company assets after all of the liabilities have been paid off. What the owner owes the business D.

Property held for sale in the ordinary course of business b. The owners interest or worth in the business C. The result is the owners equity in the business.

Owners equity represents the owners investment in the business minus the owners draws or withdrawals from the business plus the net income or minus the net loss since the business began. This answer has been confirmed as correct and helpful. How to Calculate Owners Equity.

4 Which BEST describes an owners equity in the property. If a homeowner purchases a home for 100000 with a 20 down payment covering the remaining 80000 with a mortgage the owner has equity of 20000 in the house. Equitable right of redemtion.

Balance Sheet The normal balance of Accounts Payable. Equity Assets - Liabilities. More generally it is.

Which of the following best describes owners equity. Select one or more. Its the amount the owner has invested in the business minus any money the owner has taken out of the company.

Which best describes an owners equity in the property. Owners equity is calculated by adding up all of the business assets and deducting all of its liabilities. Generally speaking its your homes fair market value less any mortgage balances or existing liens including the balance you owe on your mortgage.

Whats left over is equity. This equation is most commonly associated with sole traders. It is equal to the assets less the liabilities.

Added 1182014 83616 AM. Best describes owners equity.

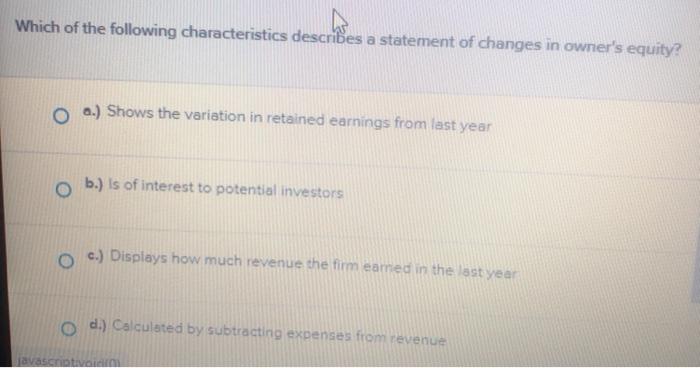

Solved 4 Which Of These Best Describes An Income Statement Chegg Com

Owner S Equity Learn How To Calculate Owner S Equity

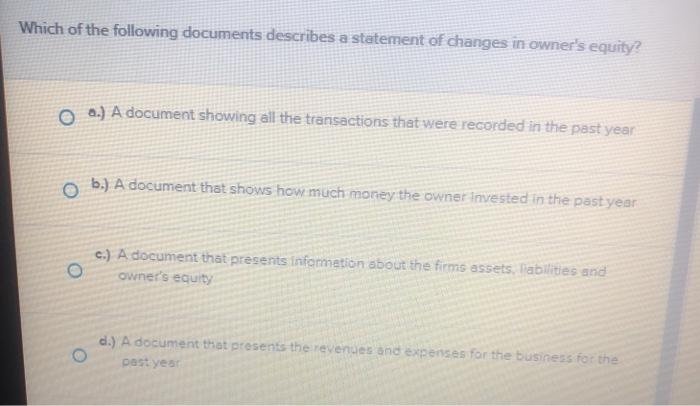

Solved Which Of The Following Documents Describes A Chegg Com

No comments for "Which Best Describes an Owner's Equity in the Property"

Post a Comment